indiana excise tax alcohol

Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. Get a copy of the Indiana alcohol and tobacco laws.

Alcohol Taxes On Beer Wine Spirits Federal State

File a complaint against an alcohol or tobacco business.

. Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon. Gasoline Cigarette and Alcohol Excise Tax Rates By State. Excise Tax Calculation Wine Tax rate 047 1.

Business Web Address Indiana Alcoholic Beverage Permit Numbers Section B. FEDERATION OF TAX ADMINISTRATORS -- JANUARY 2022 STATE TAX RATES ON DISTILLED SPIRITS January 1 2022 EXCISE GENERAL TAX RATES SALES TAX STATE per gallon APPLIES OTHER TAXES Alabama see footnote 1 Yes Alaska 1280 na. Gallons Received During Reporting Month from Schedule ALC-W-S Transaction Type A.

Look up an alcoholic beverage permit online. Our mission is to provide quality service and to protect the morals and welfare of the people of the State of. Indiana Alcoholic Beverage Permit Numbers Section B.

Alcoholic Beverage Wholesalers Excise Tax Return. State Excise police officers are empowered by statute to enforce the laws and rules of the Alcohol Tobacco Commission as well as the laws of the State of Indiana. Have a State Excise Officer speak at my school or organization.

For beer they pay an extra 11 and one-half cents. The Commission is currently reviewing the opinion to determine how if at all the decision will impact Indianas alcohol laws and permittees. Yes retailers including grocery stores convenience stores and liquor stores are permitted to sell alcohol on Sundays.

Cigarettes - 043 per pack. 3 rows Indiana Liquor Tax - 268 gallon. Tax-exempt Gallons Sold from Schedule ALC-M-S Transaction Type A.

Indiana State Excise Police. Excise Tax Calculation Wine Tax rate 047 1. Indiana Alcohol Tobacco Commission.

Excise taxes are commonly levied on cigarettes alcoholic beverages soda gasoline insurance premiums amusement activities and betting and make up a relatively small and volatile portion of state and local tax collections. The excise taxes paid by producers importers wholesalers and retailers increase the amounts used to calculate sales tax. Gallons Returned to Manufacturer from Schedule ALC-M-S.

An excise tax is a tax imposed on a specific good or activity. Gas - 1600 per gal. Total Gallons Sold from Schedule ALC-DWS-S Transaction Type A.

Liquor - 1822 per gallon. Cigarettes - 200 per pack. And for wine the pay an extra 47 cents.

Can you buy alcohol in Indiana on Sunday. Gallons Taken Out of Bond. Alcohol Taxes in Indiana.

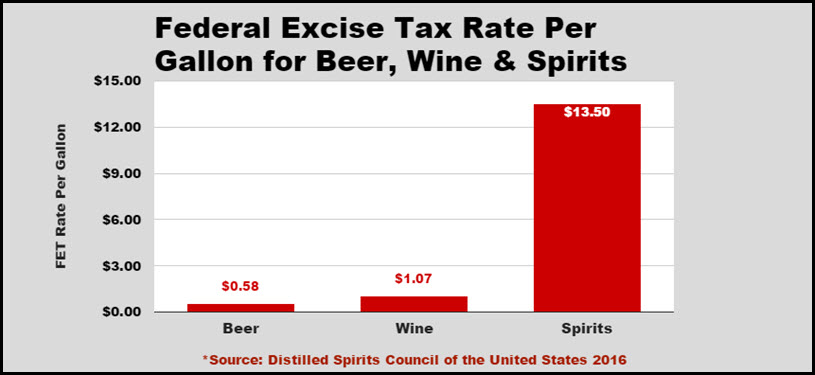

In addition to or instead of traditional sales taxes cigarettes and other tobacco products are subject to excise taxes on both the Indiana and Federal levels. Excise taxes on tobacco are implemented by every state as are excises on alcohol and motor fuels like gasoline. The federal government collects approximately 1 billion per month from excise alcohol taxes on spirits beer and wine.

Federal Fuel Excise Taxes. Tax-exempt Gallons from Schedule ALC-FW-S Transaction Type A. All forms must be filed electronically.

Therefore consumers then pay sale tax on the excise taxes. Gallons Returned to ManufacturerImporter or Destroyed from Schedule ALC-W-S Transaction Type B. Excise Police Indiana State 10 Articles Follow New articles New articles and comments Do I need any type of permit to dispense alcoholic beverages at my one time event.

Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1. Attend a certified server training program in my area. Property Tax Clearance Schedule SF 1463 Effective August 21 2017 all Property Tax Clearance Schedules must be stamped with an embossed seal from the county treasurer Complete Only Applicable Forms.

INtax Indianas free online tool to manage business tax obligations includes alcohol taxes. NOTICE - The Indiana Alcohol Tobacco Commission and the Indiana State Excise Police announce the start of the PACE program Proactive Alcohol Compliance Enforcement. INtax only remains available to file and pay the following tax obligations until July 8 2022.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Liquor - 1280 per gallon. Please visit the Electronic Filing for Alcohol Taxpayers webpage for electronic filing information.

Gallons Returned to Winery from Schedule ALC-DWS-S Transaction Type C. Under 21 - 250gallon Arizona 300 Yes. Other Indiana Excise Taxes.

The Indiana State Excise Police is the law enforcement division of the Alcohol Tobacco Commission. Physical AddressCityStateZIP Indiana Tax Identification Number Mailing AddressCityStateZIP Telephone Number Business Web Address Indiana Alcoholic Beverage Permit Numbers Section B. Federal excise tax rates on various motor fuel products are as follows.

The paper forms with instructions shown below are available so customers can visualize what is required. Although electronic filing is required paper forms with instructions are available so customers can visualize what is required. There are three options for electronically filing.

AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. Indianas general sales tax of 7 also applies to the. The price of all motor fuel sold in Indiana also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway Administration.

Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1. Consumers pay 268 per gallon 637 per 9 L cs and 053 per 750ml bottle. Tax-exempt Gallons Sold from Schedule ALC-DWS-S Transaction Type B.

Indiana has a state excise tax. Gallons Withdrawn for Sale or Gift in Indiana. Apply for employment as an Indiana State Excise Police officer.

Gas - 800 per gal.

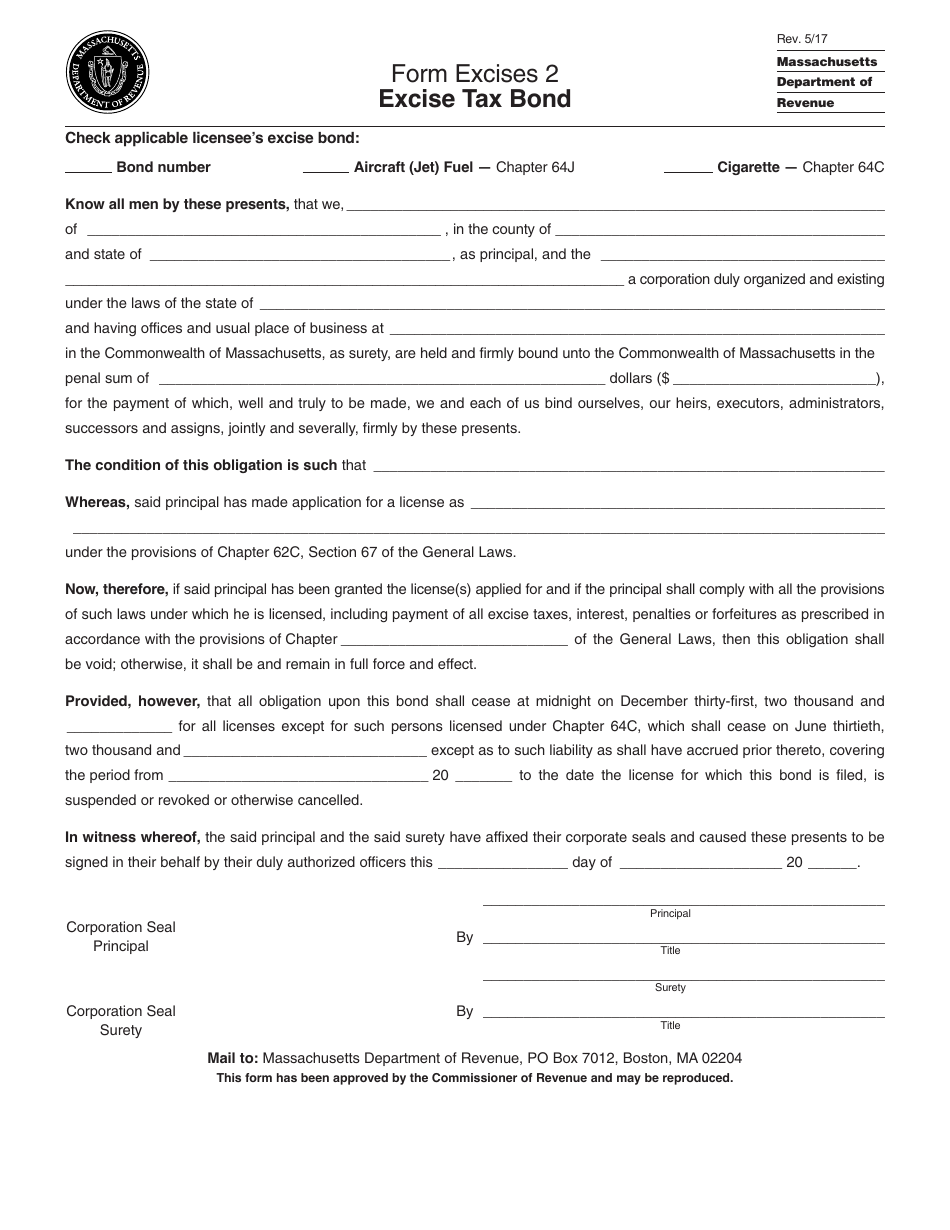

Form Excises2 Download Printable Pdf Or Fill Online Excise Tax Bond Massachusetts Templateroller

Alcohol Taxes On Beer Wine Spirits Federal State

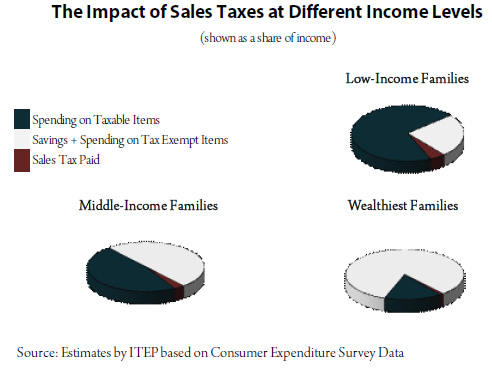

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

How Sales And Excise Taxes Work Itep

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

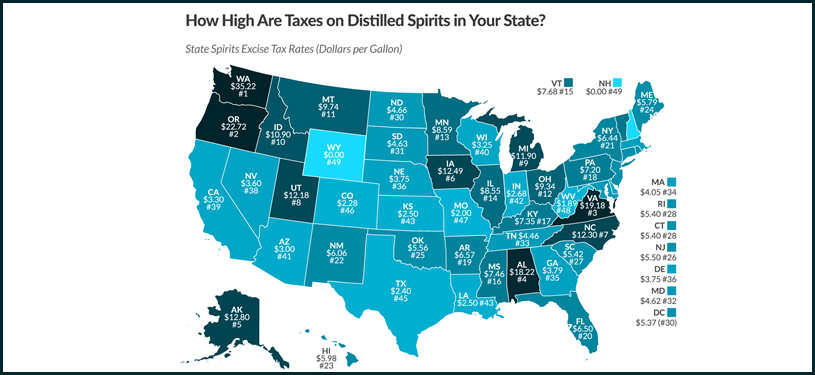

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

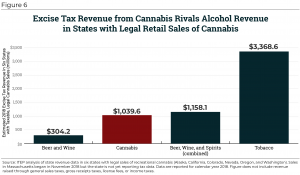

Cannabis Tax Debates Are Ramping Up Here S What We Ve Learned From Five Years Of Cannabis Taxation Thus Far Itep

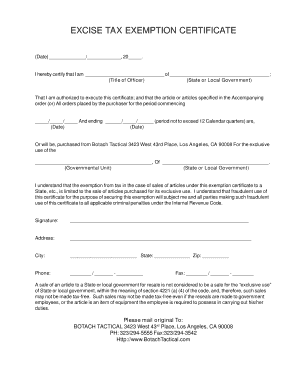

Federal Excise Tax Exemption Certificate Pdf Fill Online Printable Fillable Blank Pdffiller

State Cigarette Excise Tax Rates United States April 2015 Download Scientific Diagram

Compensating State And Local Governments For The Tax Exempt Status Of Federal Lands What Is Fair And Consistent Everycrsreport Com

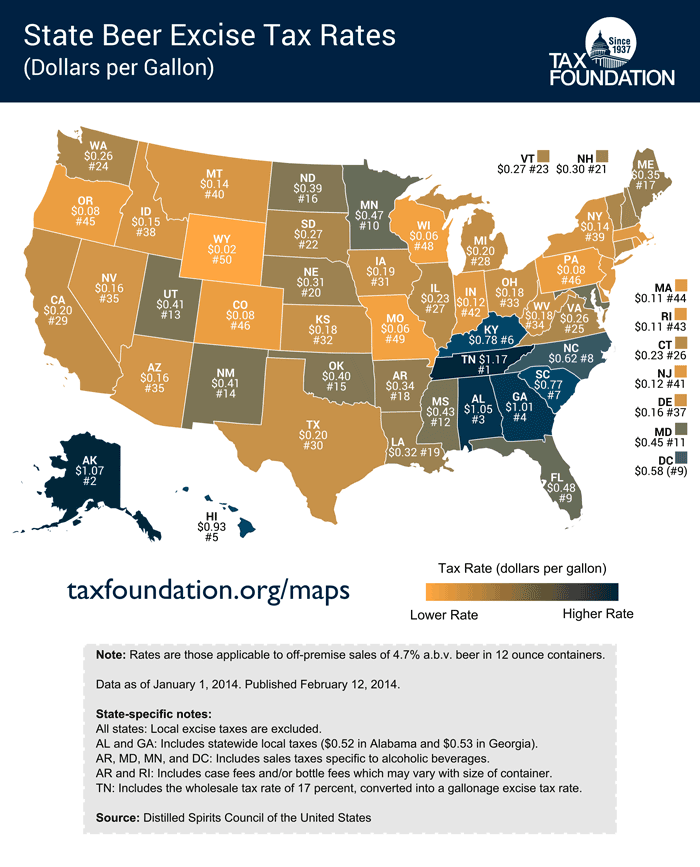

These States Have The Highest And Lowest Alcohol Taxes

State Alcohol Excise Tax Rates Tax Policy Center

How Is Tax Liability Calculated Common Tax Questions Answered

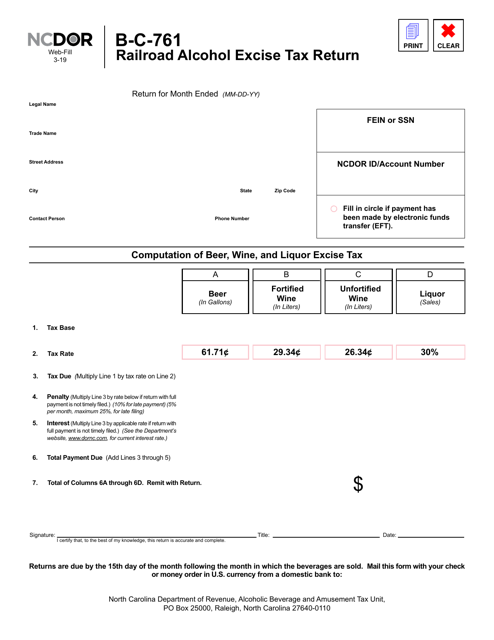

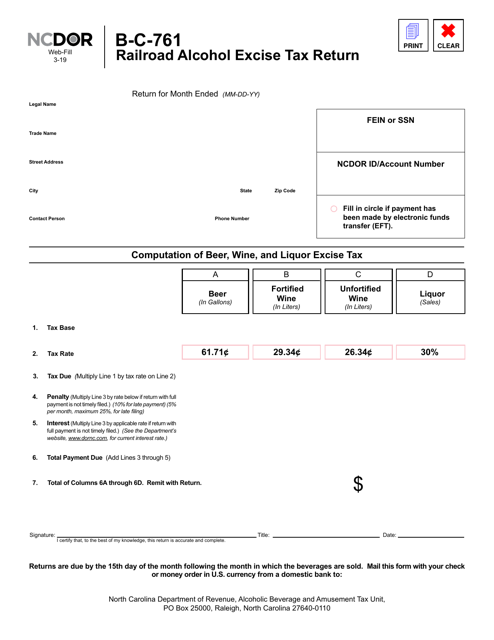

Form B C 761 Download Fillable Pdf Or Fill Online Railroad Alcohol Excise Tax Return North Carolina Templateroller

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

President Signs 2 3 Trillion Bill Making Federal Excise Tax Fet Reduction Permanent For Distilleries Step 3 Of 3 Distillery Trail